Managing personal finances can be a tricky task, especially when trying to track spending across multiple platforms and services. In today’s digital age, keeping tabs on receipts and transactions has become more important than ever. Receiptify is an innovative tool designed to simplify the process of managing your expenses. It allows users to easily track their purchases and stay on top of their budgets, all while offering a user-friendly experience.

In this article, we will explore how Receiptify works, its key features, and why it stands out as an ultimate personal expense tool. You’ll also learn about Receiptify Spotify and how it integrates seamlessly with your digital lifestyle.

One of the platform’s most exciting features is its ability to track spending across different categories such as food, entertainment, and transportation. It then provides users with a clear breakdown of where their money is going. This level of visibility helps individuals stay within their budget and make more informed decisions about their spending habits.

Key Features of Receiptify

1. Automatic Receipt Generation

A major feature of Receiptify is its ability to automatically generate receipts from a variety of purchase methods. Whether you make a purchase online or in-store, Receiptify captures the transaction and organizes it for you. Users simply need to link their payment methods to the platform, and Receiptify takes care of the rest.

This feature eliminates the need to manually upload receipts or worry about losing them. As soon as a transaction is made, the receipt is captured, and you can access it anytime, anywhere. This convenience makes managing personal expenses much easier and more efficient.

2. Expense Categorization

One of the most useful features of Receiptify is its ability to categorize expenses automatically. Every purchase is tagged under specific categories like groceries, entertainment, transportation, and dining. The platform also allows users to create custom categories if needed. This organization helps users understand exactly where their money is going each month.

For example, you might realize that you’re spending more on dining out than you thought, or that your grocery bills have been creeping up over the last few weeks. With Receiptify, these insights are easy to spot, allowing you to make adjustments to your spending habits quickly.

3. Budget Tracking and Alerts

With Receiptify, users can set up budgets for different spending categories. The tool will monitor your spending and alert you when you’re close to exceeding your budget in any given category. This feature is particularly helpful for individuals who are trying to save money or stick to a financial plan.

By receiving alerts when you’re close to hitting your budget limit, you can make more conscious decisions about future purchases. Whether it’s avoiding an impulse buy or cutting back on unnecessary expenses, Receiptify helps you stay on track with your financial goals.

4. Integration with Other Financial Tools

Receiptify doesn’t just track your expenses — it also integrates with other financial tools to give you a comprehensive view of your financial health. For example, if you use a budgeting app or personal finance software like Mint or YNAB (You Need a Budget), Receiptify can sync with these tools to make sure all your financial data is up to date.

By combining Receiptify’s receipt tracking with other financial management platforms, you get a full picture of your spending habits, savings, and investments. This integration helps you make smarter financial decisions and avoid overspending.

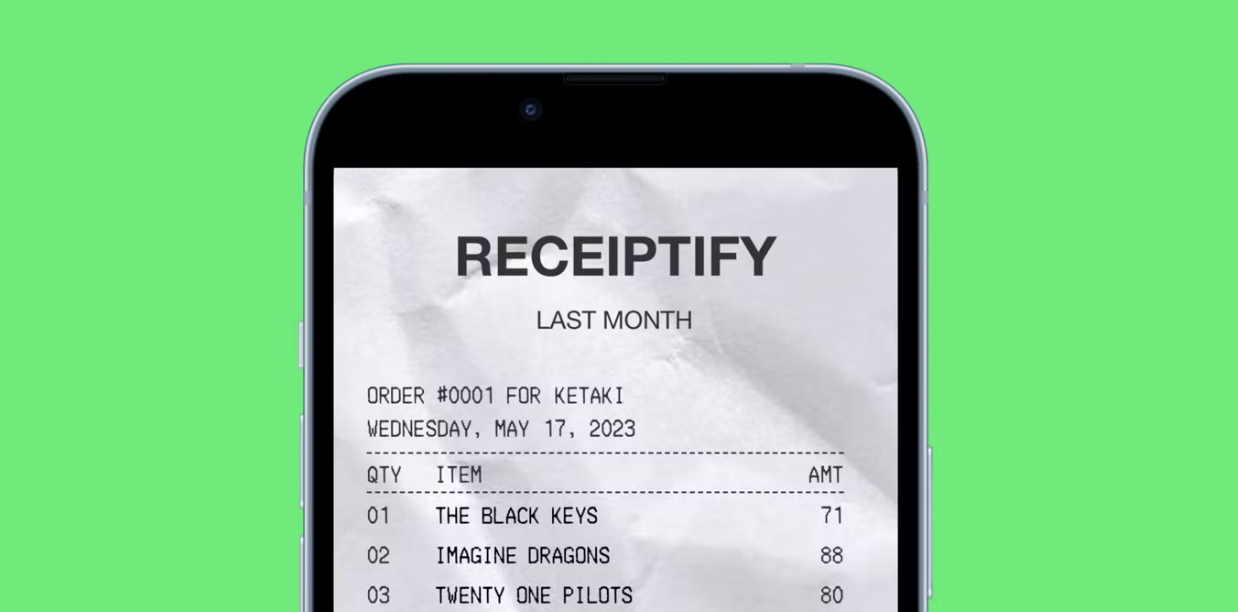

The Receiptify Spotify Integration

Receiptify Spotify is an exciting feature that blends personal finance tracking with a touch of entertainment. It connects your Spotify account with Receiptify to track and categorize purchases related to your music and streaming habits. If you’ve ever wondered how much you’re spending on subscriptions, Spotify purchases, or in-app purchases, Receiptify Spotify offers an easy way to keep track of it all.

When you link your Spotify Receiptify, it automatically records your Spotify-related purchases, such as premium subscriptions, music downloads, and any other related charges. This is particularly helpful for those who use Spotify frequently and want to know exactly how much they are spending on their music and entertainment habits.

Not only does Receiptify Spotify track purchases, but it also helps users set budgets for entertainment and streaming services. This can be a useful tool for individuals who want to keep their entertainment spending in check, ensuring they don’t exceed their monthly budget.

How to Use Receiptify

Using Receiptify is simple and straightforward. To get started, follow these easy steps:

- Sign Up: Visit https://receiptifyinsights.com/ and create an account. You can sign up using your email address or social media accounts for a quick registration process.

- Link Your Payment Methods: Once your account is set up, link your credit card, bank account, and other payment methods. This allows Receiptify to automatically track and capture your receipts.

- Set Budgets: After linking your payment methods, you can set up personalized budgets for different spending categories. Whether you want to track food expenses, entertainment, or other areas of your life, Receiptify gives you the flexibility to manage your finances your way.

- Review Your Spending: Once everything is set up, you can start reviewing your spending habits. Receiptify provides a clear breakdown of your expenses and gives insights into where your money is going. You can access this data at any time through the platform’s easy-to-use dashboard.

- Receive Alerts and Stay On Track: As you make purchases, Receiptify will keep track of your spending and send you alerts if you’re nearing your budget limit. This helps you avoid overspending and stay within your financial goals.

Why Choose Receiptify?

Receiptify stands out as an essential tool for managing personal expenses due to its simplicity, automation, and versatility. Whether you’re looking to track receipts, categorize expenses, or stay on top of your budget, Receiptify provides everything you need in one place. The integration with other financial tools and the Receiptify Spotify feature make it a comprehensive solution for anyone serious about personal finance management.

If you’re ready to take control of your spending and simplify your financial life, visit https://receiptifyinsights.com/ and start using Receiptify today. With its easy-to-use platform and powerful features, Receiptify is the ultimate personal expense tool for anyone looking to make smarter financial decisions.

Conclusion

Managing personal finances doesn’t have to be complicated. With Receiptify, you can easily track your expenses, stay within your budget, and gain valuable insights into your spending habits. The platform’s automatic receipt generation, expense categorization, and integration with other financial tools make it the ideal solution for those looking to simplify their financial management. Don’t forget to take advantage of the Receiptify Spotify integration to manage your music and entertainment subscriptions. Visit https://receiptifyinsights.com/ to get started today!